“People worry that computers will get too smart and take over the world, but the real problem is that they’re too stupid and they’ve already taken over the word” – Pedro Domingo, Professor of Computer Science

During the first months of my career in auditing, I have heard about Neural Network in the Audit, today we use the term Deep Learning.

Due to the three main technological drivers during recent years; digitization, cloud computing and Internet of Things, we are talking about the “new” kids in (technology) town”, obviously Artificial Intelligence (AI). We are moving into the Age of AI. Since I am a passionate believer of both Auditing and Analytics, I am very much interested in the key question: How Will AI Transform The Audit?

To answer that question, I have been studying the impact of AI in different sectors, read some highly recommended books on the topic of Analytics and AI and have been (over)thinking the question in my mind.

We can all agree we are amidst of a perfect storm when it comes to adopting AI. Thanks to our cell phones, tablets, sensor-operated devices, cloud systems, we have an incredible amount of data being generated. According to tech writer Bernard Marr, there is 2.5 quintillion bytes of data generated every day[1]. Google processes 3.5 billion searches per day, Twitter users view 1.000.000 videos every minute and 156 million emails are send every minute as well. It is an unbelievable amount of both structured and unstructured data.

When it comes to AI, I want to limit my scope to answering the foregoing question to Machine Learning, this because it is fair to say that the recent excitement about the possibilities of AI is primarily due to the advances in Machine Learning, enabled by superior computer infrastructure combined with vast data repository at our disposal.

True, AI, often referred to as Artificial General Intelligence (AGI), the true mimic of humankind behavior, hardly exists, or as most experts state in their books and articles; “we are far away from AGI”.

To further limit the scope, I have listed below the four types of Machine Learning, broadly grouped into:

- Supervised Learning – learn a model based on already available “right” answers (requires labeling of data)

- Unsupervised learning – learn the inherent structure of data without using external labels

- Semi-Supervised learning – combining unlabeled data with labeled data to produce predictions

- Reinforcement Learning – this is all about optimizing a certain goal of reward – the most famous example is AlphaGo, the system that became a world-beater at Go.

I have also excluded all recent talks about the introduction of E-currencies and other Blockchain technology replacing current monetary system and IT-Accounting systems.

So back to the question: How Will AI Transform The Audit?

From reading many different articles and books, reviewing many different case studies, I have noted very few Machine Learning business cases in the Audit. However, looking at the examples in other sectors, looking at the four groups of Machine Learning, I am interested in further piloting Machine Learning in the audit in a context outlined below.

First, considering the specifics of each audit / assurance setting, still applicable today in combination with the availability of structured data, I believe that Unsupervised Learning can take us into the right direction.

The goal of using Unsupervised Learning, more specific, an Artificial Neural Network (ANN) in the audit is to gain insights from the features X1, X2, X3 etc. Unlike Supervised Learning (e.g. spam prediction, home price predictions e.g.) there is not a target per se.

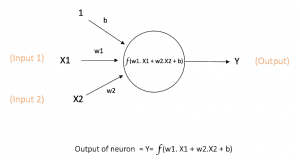

We can simply Unsupervised Learning by this image[2];

An Artificial Neural Network is a computational model that is inspired by the way biological neural networks in the human brain process information. Artificial Neural Networks have generated a lot of excitement in Machine Learning research and industry, thanks to many breakthrough results in speech recognition, computer vision and text processing. Maybe Auditing is next?

Again, to make it simple, I am interested in the output Y, whereby the above network takes numerical inputs X1 and X2 and has weights w1 and w2 associated with those inputs. Additionally, there is another input 1 with weight b (called the Bias) associated with it. In order to keep simple, I will not discuss the model itself further, instead I want to brainstorm about “Y”.

The output Y is computed as shown in figure above. The output “Y” represents insight in unlabeled data, unbiased insights.

Let’s brainstorm for a minute:

Brainstorm 1: Cash Receipts

X1 – all bank payments

X2 – all purchase invoices

What kind of “Y” do we expect?

I can hear you thinking, you want to have an alert of bank payments that are potential fraudulent or incorrect? But how would the model recognize a payment being fraudulent when we are applying unsupervised learning, as there are no “right answers”?

Well, what I understand is that we can use a technique called backpropagation, simply put by reviewing the outputs Y, we are getting a sense of the errors resulting from the network. So, each time the output is incorrect (read: no fraud) – we tell the network, and the parameters are adjusted.

Brainstorm 2: Sales

X1 – all bank receipts

X2 – all sales orders and status

X3 – all sales invoices

Again, what do we expect from “Y”?

In this example, I would not be too excited about the obvious output such as “sales order completed / no sales invoice issued” or “invoiced incomplete versus order and shipped”. We can use data-analytics for this. So, what is it we are expecting from a Neural Network here?

A neural network may predict which sales order and invoices will not be paid? Maybe more accurate compared to management estimates? This will support the review of AR provisions. Will a neural network predict loss making sales transactions when we add a X4 (cost of sales)?

So, in case you have 100 audit clients, you will need to train the network to also understand the specifics of 100 audit clients. How that will work is a matter of piloting and implementation, which at Coney Minds, we are doing since 2021.

Is this exciting enough? Is this going to change the way we audit? To be honest I don’t know. What I do know that there is a competitive edge in integrating Machine Learning in the audit when we are able to provide better, faster, more insightful output compared to using data-analytics and statistics today.

I recently decided to make a step forward by hiring a senior Data Science team member at Coney Minds to explore the use of Machine Learning in the audit, to inspire my data-analytics team and to share know-how with my team.

I am also looking forward to keeping working with data-science firms in further discovering the possibilities of Machine Learning in the audit as well as in the (business) controlling area.

I invite all my fellow auditors in exploring this model and brainstorm about the two following sub-questions:

- Which audit questions today can be answered by an “Y” in a more effective and efficient manner we cannot answer today with Analytics?

- Do we feel that by using a Neural Network, the outcome of “Y” will provide different, more insightful results compared to using Analytics or other substantive audit techniques?

I am looking forward to discussing Machine Learning in the Audit further with other audit firms and business controlling teams. Please read more here.

[1] “How much data we do create every day? The mind blowing stats everyone should read” Marr (2018)

[2] Image source: A Quick Introduction to Neural Networks” (Kam, 2016)