The main objectives of our financial due diligence are:

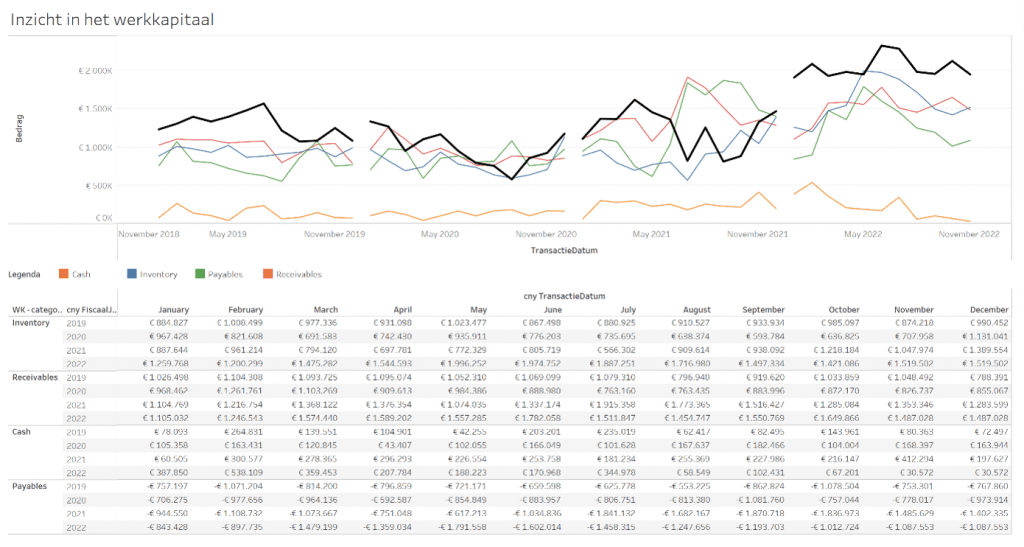

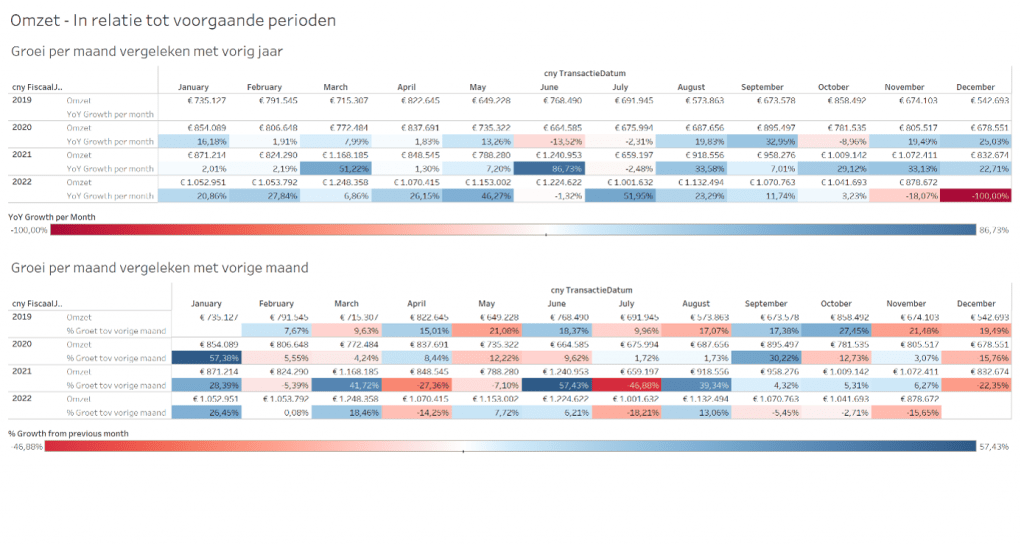

- Providing insight into financial risks and opportunities,

- Provide insight into the most important value drivers of the company,

- Testing initial assumptions and criteria (including for your valuation of the company), in particular by analyzing:

– the underlying historical financial information;

– interim financial developments; and

– the company’s financial expectations

– in collaboration with Coney Tax – the tax (compliance) positions, - Gain insight into the quality of internal control (including IT), risk management and quality culture.